Good Afternoon,

First post, love the info on this forum. I'm looking to purchase a local car wash in my hometown. It's an existing 4 bay SS with 2 IBA's, that's been open for about16 years or so. VERY WELL maintained, and I was told by the distributor it's one of the most well maintained, nicest washes around. The Touchless is an Oasis Typhoon that was put in all new in 2020, the soft touch is an older Ryko that is original. Owner is retiring and is looking to sell. This would be my fist car wash but I have a strong business background and have financing in place. Strong cash flow and excellent financial history on the business.

Purchase price is $600,000 which is about 3.5X earnings.

2 issues I'm struggling with: #1) A new Express tunnel wash just open up literally across the street q4 of last year. Q4 numbers were down 25% year over year on this wash (I was told the new wash was giving away free washes initially), and it's still down 9% in Q1 of 2022, but I'm not just sure of the long term effects of this new wash.

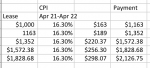

#2) The lease. This is located just off of main street in a booming and growing part of town that's right in the path of progress. Lot's of new building within a few miles of this great location. Existing rent has been about 25-28% of gross sales, but the new lease I would have to sign (15 years) would be 32% of gross and will likely go up from there, as it's tied to the Consumer price index and we all know what inflation is doing right now. This concerns me greatly as we may be moving towards a recession and rates will most likely keep climbing for a year +.

I'm looking at overall thoughts on this deal from those with lot's of experience. Is 3.5x to high without real estate? Experience with competition being so close? What else should I be looking at? I can provide more info as well.

Thanks in advance!

First post, love the info on this forum. I'm looking to purchase a local car wash in my hometown. It's an existing 4 bay SS with 2 IBA's, that's been open for about16 years or so. VERY WELL maintained, and I was told by the distributor it's one of the most well maintained, nicest washes around. The Touchless is an Oasis Typhoon that was put in all new in 2020, the soft touch is an older Ryko that is original. Owner is retiring and is looking to sell. This would be my fist car wash but I have a strong business background and have financing in place. Strong cash flow and excellent financial history on the business.

Purchase price is $600,000 which is about 3.5X earnings.

2 issues I'm struggling with: #1) A new Express tunnel wash just open up literally across the street q4 of last year. Q4 numbers were down 25% year over year on this wash (I was told the new wash was giving away free washes initially), and it's still down 9% in Q1 of 2022, but I'm not just sure of the long term effects of this new wash.

#2) The lease. This is located just off of main street in a booming and growing part of town that's right in the path of progress. Lot's of new building within a few miles of this great location. Existing rent has been about 25-28% of gross sales, but the new lease I would have to sign (15 years) would be 32% of gross and will likely go up from there, as it's tied to the Consumer price index and we all know what inflation is doing right now. This concerns me greatly as we may be moving towards a recession and rates will most likely keep climbing for a year +.

I'm looking at overall thoughts on this deal from those with lot's of experience. Is 3.5x to high without real estate? Experience with competition being so close? What else should I be looking at? I can provide more info as well.

Thanks in advance!